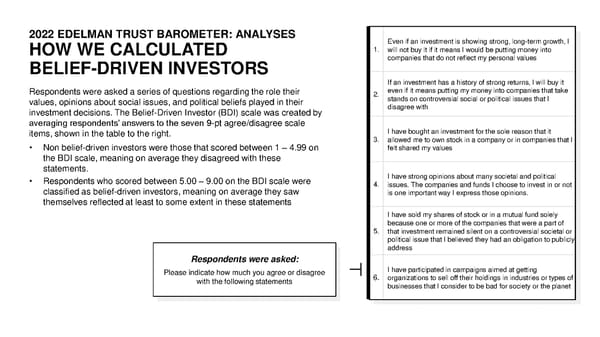

2022 EDELMAN TRUST BAROMETER: ANALYSES Even if an investment is showing strong, long-term growth, I HOW WE CALCULATED 1. will not buy it if it means I would be putting money into BELIEF-DRIVEN INVESTORS companies that do not reflect my personal values If an investment has a history of strong returns, I will buy it Respondents were asked a series of questions regarding the role their 2. even if it means putting my money into companies that take values, opinions about social issues, and political beliefs played in their stands on controversial social or political issues that I investment decisions. The Belief-Driven Investor (BDI) scale was created by disagree with averaging respondents’ answers to the seven 9-pt agree/disagree scale items, shown in the table to the right. I have bought an investment for the sole reason that it 3. allowed me to own stock in a company or in companies that I • Non belief-driven investors were those that scored between 1 – 4.99 on felt shared my values the BDI scale, meaning on average they disagreed with these statements. • Respondents who scored between 5.00 – 9.00 on the BDI scale were I have strong opinions about many societal and political classified as belief-driven investors, meaning on average they saw 4. issues. The companies and funds I choose to invest in or not is one important way I express those opinions. themselves reflected at least to some extent in these statements I have sold my shares of stock or in a mutual fund solely because one or more of the companies that were a part of 5. that investment remained silent on a controversial societal or political issue that I believed they had an obligation to publicly address Respondents were asked: Please indicate how much you agree or disagree I have participated in campaigns aimed at getting with the following statements 6. organizations to sell off their holdings in industries or types of businesses that I consider to be bad for society or the planet

2022 Trust Barometer Page 58 Page 60

2022 Trust Barometer Page 58 Page 60